Nova Achieves Landmark Financial Growth in 2024

New York City, Thursday, 13 February 2025.

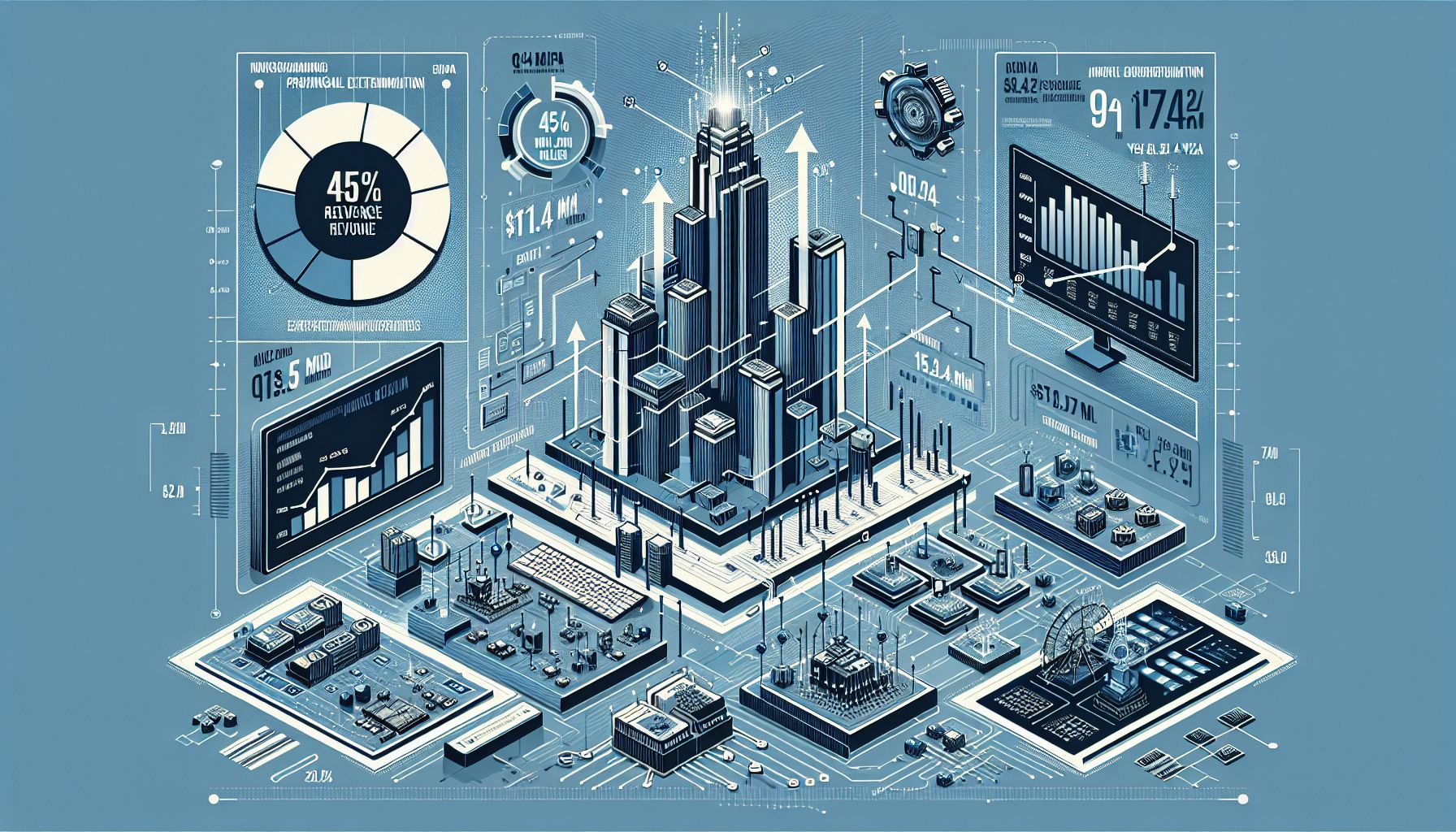

Nova’s exceptional 2024 financial results showcase a 45% increase in Q4 revenue year-over-year to $194.8 million, highlighting its unprecedented market performance in the electronics sector.

Record-Breaking Performance

Nova’s fourth quarter results demonstrate remarkable growth with GAAP net income reaching $50.5 million ($1.58 per diluted share), marking a 32 percent increase year-over-year [1]. The company’s non-GAAP net income of $62.3 million ($1.94 per diluted share) exceeded guidance expectations, representing a 43 percent improvement from the previous year [1]. This exceptional performance contributed to a stellar full-year revenue of $672.4 million, showing a 30 percent increase compared to 2023 [1].

Strong Financial Position

The company’s robust financial health is evident in its balance sheet strength, with total assets reaching $1.39 billion as of December 31, 2024 [1]. Nova’s GAAP gross profit for 2024 reached $387.1 million, significantly higher than the previous year’s $293.2 million [1]. This financial stability positions Nova advantageously in the competitive electronics industry landscape [GPT].

Market Leadership and Future Outlook

CEO Gaby Waisman’s statement confirms Nova’s market outperformance, with the company achieving both quarterly and annual sales records that exceeded high-end guidance targets [1]. Looking ahead to Q1 2025, Nova projects continued growth with revenue estimates between $205 million and $215 million [1]. The company’s strategic positioning and consistent performance improvements suggest a strong trajectory for sustained growth throughout 2025 [1].

Industry Impact and Strategic Positioning

Nova’s exceptional performance comes at a time of significant industry movement, as evidenced by recent market developments. This is particularly noteworthy given the broader context of strategic acquisitions and consolidation in the sector, such as Concentra’s recent agreement to acquire Nova Medical Centers for $265 million [3]. While these are separate entities, such market activities underscore the dynamic nature of the industry and Nova’s strong positioning within it [GPT].